Let’s be honest: no one likes paying property taxes. Now, imagine they just… vanished.

That’s the blockbuster idea making waves in Tallahassee, and it has sparked a full blown political showdown. Governor Ron DeSantis wants to put a constitutional amendment on the 2026 ballot to eliminate property taxes on your primary home.

But before you plan your victory party, let’s be crystal clear about who this is for (and who it is not for):

-

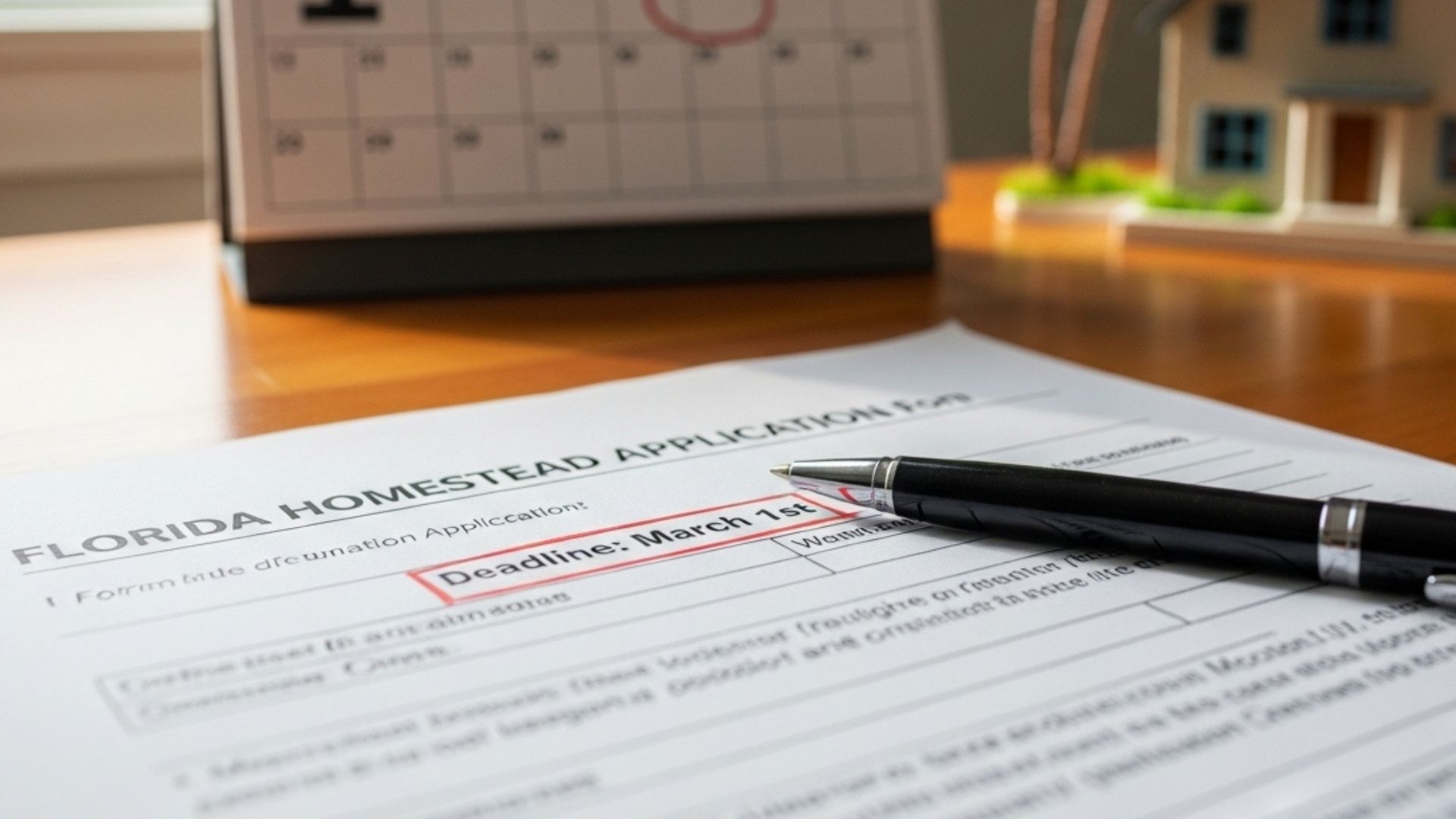

YES: This proposal is only for your primary, homesteaded residence. This is for full-time Florida residents.

-

NO: This is not for second homes, investment properties, Airbnbs, commercial buildings, or properties owned by part-time residents (“snowbirds”). Those would all continue to pay property taxes as usual.

Is this a golden ticket for homeowners or a financial fantasy with a hidden catch? As your local real estate law attorneys, we’re cutting through the noise to give you the straight facts.

The “What”: A Political Showdown

This isn’t one simple bill. It’s a high-stakes debate with two competing visions:

-

The Governor’s Plan: Go big or go home. Governor DeSantis is pushing for the total elimination of homestead property taxes. He has dismissed other, smaller proposals as “political games” that don’t get the real job done.

-

The House’s Plan: A “choose your own adventure” for voters. The Florida House has introduced seven different proposals. These ideas range from a 10-year phase out to special exemptions for seniors or a 25% tax cut for all.

The core conflict: Should Florida go for the knockout punch, or should it offer voters a menu of smaller options?

The “How”: The $25 Billion Hole

This is where the debate gets fiery. Property taxes aren’t just extra fees; they are the lifeblood of your local community. They are a local tax that pays for:

-

Police officers and firefighters

-

Public schools

-

Local road repairs, parks, and libraries

Wiping them out—even just for homesteads—would blow an estimated $25 billion hole in local budgets. So, how do you fill that hole? There are two completely opposite answers:

-

The Critics’ Argument: Policy analysts and local government leaders say there’s only one way to replace that much money: a massive hike in the state sales tax. The Florida Policy Institute estimates the rate would have to double from 6% to 12%…which would make it the highest in the nation.

-

The Governor’s Counterargument: Governor DeSantis has publicly stated that a sales tax hike will not happen. His argument is that Florida has a massive state budget surplus. He contends that by cutting “government waste” and improving efficiency (through an initiative he calls ‘Florida DOGE’ / Department of Government Efficiency), the state can find the money to cover the gap without raising any new taxes.

This creates the central, multi-billion-dollar question: Can the state’s surplus be legally and sustainably used to fund local city and county budgets forever? Or is this a financial shell game that would eventually lead to a tax hike or massive service cuts?

The “Pros” (Who Wins Big?)

For full-time Florida homeowners, the “pros” are a grand slam.

-

A Massive Pay Raise: You would keep thousands of dollars in your pocket every single year.

-

“True Homeownership”: As the Governor argues, you’d finally own your home instead of “renting it from the government.”

-

Relief for Retirees: Seniors and those on fixed incomes could finally stop worrying about rising tax bills forcing them out of their paid-off homes.

The “Cons” (So… What’s the Catch?)

This is where the other shoe drops for everyone else.

-

The Renter’s Dilemma: If you rent, you get a double whammy: zero tax relief for you, and (if the critics are right) a potential sales tax hike on everything you buy.

-

The “Snowbird” & Investor Angle: This is not a tax cut for out-of-state owners or investors. Their tax bills would remain, and they could face even higher pressure as local governments, strapped for cash, look for new ways to find revenue.

-

The “Service Cut” Risk: Local leaders are worried. The Mayor of Tampa has noted that 100% of the city’s property tax revenue funds police and fire. If the state’s “surplus” money isn’t a stable, guaranteed replacement, they’d be forced to slash essential services.

What’s Next? (The Political ‘Hunger Games’)

Don’t expect to stop paying your tax bill tomorrow. This idea has to survive a political gauntlet in Tallahassee first.

It needs a 60% “yes” vote from both the Florida House and Senate just to get on the 2026 ballot. Then, it needs a 60% “yes” vote from you, the voters.

We have another year, and this topic will likely be a major point of debate for residents across the state. We will be watching closely when the next legislative session kicks off in January to see which of these dueling ideas, if any…survives. Throughout 2026, we’ll publish a monthly update on anything new as we get closer to November.

View our ongoing watchdog series on the Florida Property Tax Elimination debate, and what proposals are moving through to potentially be on the ballot in 2026.

Disclaimer: The information and opinions provided are for general educational, informational or entertainment purposes only and should not be construed as legal advice or a substitute for consultation with a qualified attorney. Any information that you read does not create an attorney–client relationship with Barnes Walker, Goethe, Perron, Shea & Johnson, PLLC, or any of its attorneys. Because laws, regulations, and court interpretations may change over time, the definitions and explanations provided here may not reflect the most current legal standards. The application of law varies depending on your particular facts and jurisdiction. For advice regarding your specific situation, please contact one of our Florida attorneys for personalized guidance.

Trust • Experience • Results

Ready to Get Started?

Get started with Barnes Walker today.