Quick Tips for a Successful Condominium Closing

Buyers must truly do their homework before investing in a particular condominium. Lenders must do the same. Condominium transactions involve additional layers of review, disclosures, and approval requirements that do not exist in many single family home sales.

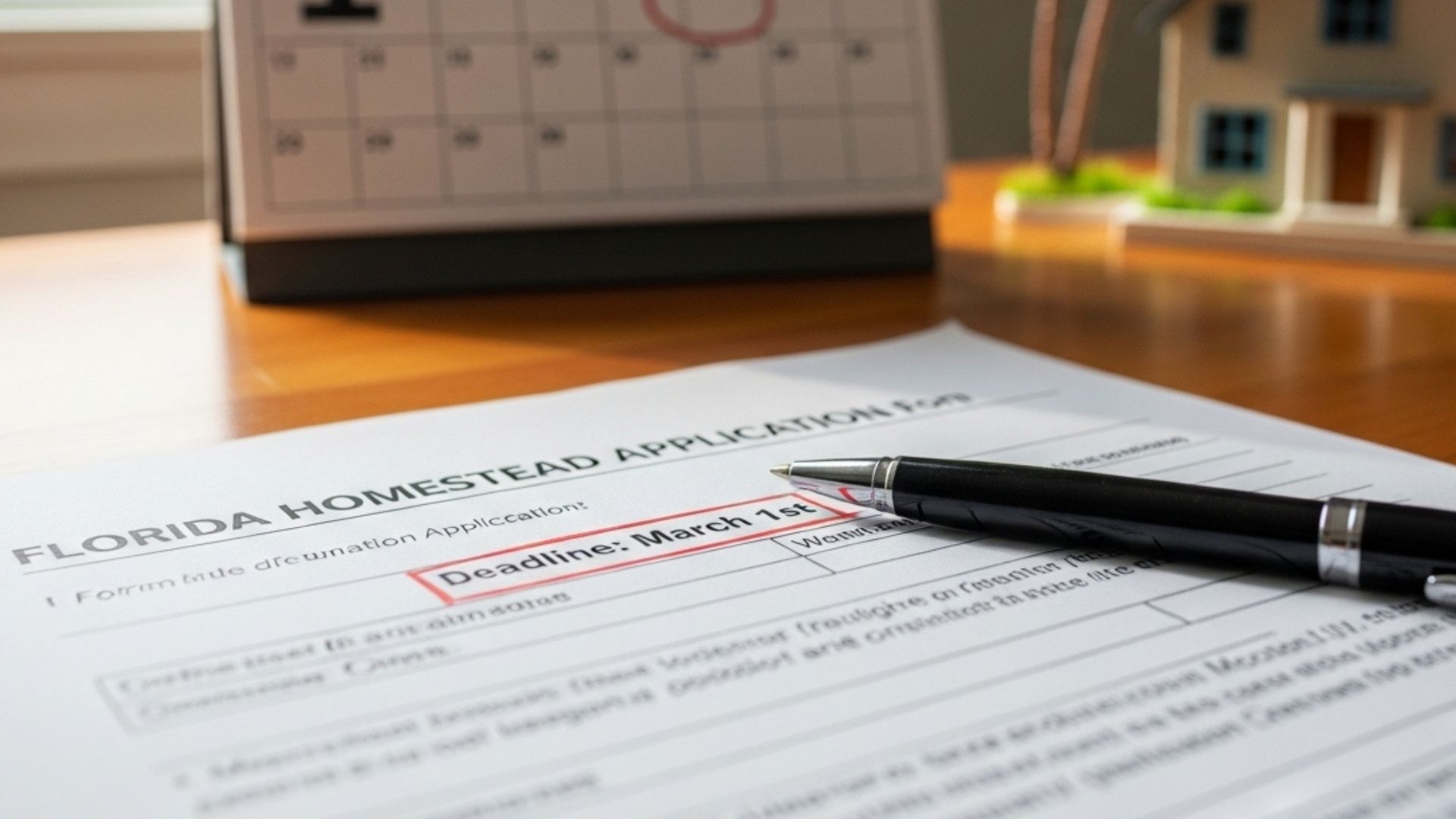

Florida law requires certain disclosures to be provided to Buyers at the time of contract. Two documents are central to this process.

Required Condominium Disclosures

The Condominium Association Disclosure requires mandatory disclosure of maintenance fees, costs, and whether Association approval is required. It also requires delivery of the Declaration of Condominium, Bylaws, and Association Rules to the Buyer, along with a three day right of rescission.

The Condominium Governance Form must also be attached to every contract. This form helps Buyers understand their rights and obligations in relation to the Association.

I. Do Your Homework – Due Diligence

Review Governing Documents

Buyers should carefully review the Declaration of Condominium, Bylaws, Amendments, and Rules to determine:

- Restrictions on unit use

- Restrictions on pets

- Restrictions on leasing

- The process required to change rules, including voting requirements

- Whether Association approval is required for purchase

- Whether parking facilities are assigned to the unit

Review Association Financial Information

Request and review financial information from the Association, including:

- Current operating budgets

- Reserve funds for repair and replacement of common elements

- Assessment collection percentages

Buyers should also determine whether:

- Many units are involved in short sales or foreclosures

- Numerous unit owners are delinquent on dues, which may increase future assessments

- The developer is still in control of the Association and whether the developer’s entity is financially viable

All of this review should be completed within three days of receipt of the documents, as Buyers may cancel the contract within that period if they identify unacceptable issues.

II. Speak with Your Lender Early

If financing is involved, Buyers should speak with their lender during the three day review period.

Loan approval guidelines differ for new condominiums, condominium conversions, and existing condominium units. Buyers should request underwriting guidelines specific to the unit and obtain any condominium questionnaire the lender will require the Association to complete.

Providing the questionnaire to the Association as early as possible helps avoid delays, surprises, or loan denial later in the transaction.

III. Perform Inspections Early

Buyers should schedule inspections as soon as possible. Issues such as roof leaks, outdated systems, mold, or termite damage may affect the decision to proceed with the purchase.

Inspection results must be delivered to the Seller within the deadlines set forth in the contract. Failure to act within these deadlines may result in waiver of inspection rights.

IV. Walk the Condominium and Speak with Neighbors

Walking the property and speaking with neighbors can provide valuable insight into the Association and the community.

Neighbors may be aware of pending repairs, assessments, disputes, or lawsuits that could result in future costs. Buyers should also ask the Association directly about pending litigation.

Requesting minutes from recent Association meetings can help Buyers understand current issues being discussed by the Board and the overall financial and operational health of the community.

V. Understand Maintenance Fees and Services

Buyers should clearly understand what services are included in the maintenance fees and verify that those services are in place for the unit.

At closing, Buyers should review the Association estoppel letter to confirm that all prior dues, assessments, liens, and late fees are being paid by the Seller. Florida law may hold a new unit owner responsible for certain unpaid assessments of prior owners.

Buyers should also determine which maintenance responsibilities fall on the unit owner and which utilities or services are included, such as water, cable, or other amenities.

Source: Barnes Walker Educational Series

Trust • Experience • Results

Ready to Get Started?

Get started with Barnes Walker today.