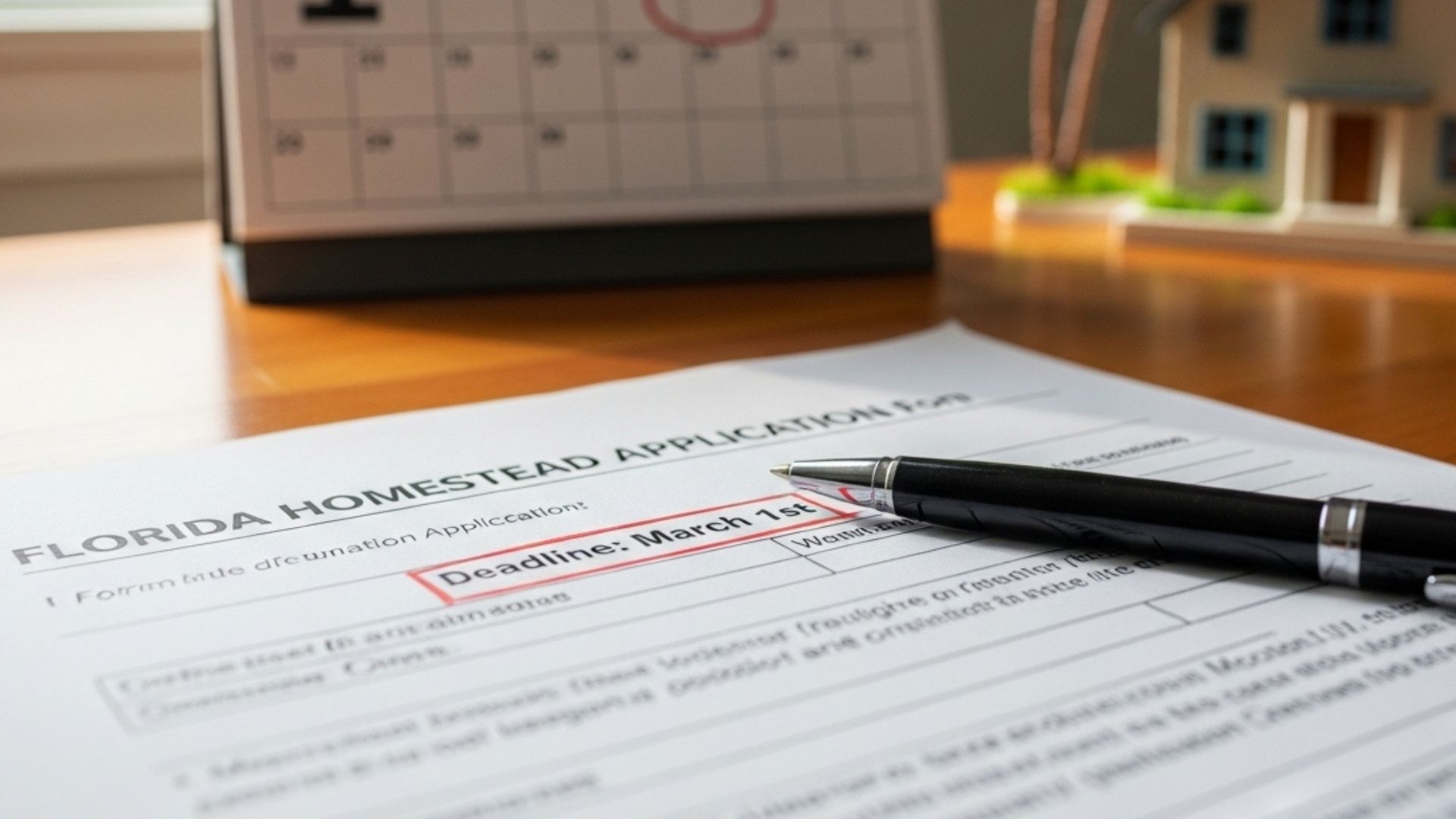

Every year, Florida homeowners see the reminder: “Homestead applications are due by March 1st.”

For many buyers — and even experienced Realtors — that single sentence can be confusing. Missing it can mean thousands of dollars in lost property tax savings.

Here’s what Florida homeowners and real estate professionals need to know.

What Is the Florida Homestead Exemption?

The Florida Homestead Exemption is a property tax benefit available to homeowners who use a Florida property as their primary residence.

When approved, it can:

- Reduce the taxable value of a home by up to $50,000

- Lower annual property tax bills

- Activate the Save Our Homes cap, limiting how much assessed value can increase each year

The exemption is administered by each county property appraiser and governed under Florida law.

What Does “Due by March 1st” Actually Mean?

In simple terms:

If a homeowner wants the Homestead Exemption for the current tax year, they must file their application with the county property appraiser on or before March 1.

If the deadline is missed:

- The exemption is usually denied for that year

- The homeowner pays higher property taxes

- Save Our Homes protections may be delayed

Florida treats March 1 as a statutory deadline, not a suggestion.

Who Needs to Apply?

A Homestead application is required if the homeowner:

- Purchased a home recently

- Moved into a new primary residence

- Never previously applied for Homestead

- Previously had Homestead on a different property

- Experienced a change in ownership, residency, or marital status

Once approved, the Homestead Exemption automatically renews each year, as long as nothing changes.

Key Timing Example

- A buyer closes on a home in 2025

- The home becomes their primary residence

- They must apply for Homestead by March 1, 2026

- The exemption applies to the 2026 property tax bill

This timing is one of the most commonly misunderstood aspects of Florida homeownership.

Why Missing the Deadline Hurts

Missing the March 1 deadline can result in:

- Higher property tax bills for the entire year

- Loss or delay of Save Our Homes protections

- Limited or no ability to fix the issue retroactively

While Florida allows a narrow late filing window in limited situations, approval is not guaranteed and deadlines are strictly enforced.

What Realtors Should Be Doing for Their Clients

For Realtors, this deadline is a major opportunity to add value beyond the closing table.

Best practices include:

- Discussing the Homestead Exemption during buyer consultations

- Including Homestead reminders in post-closing follow-ups

- Providing clients with their county property appraiser’s website

- Educating buyers through newsletters, emails, or buyer guides

Helping a buyer file Homestead on time builds trust long after the transaction closes.

Where Homeowners Apply

Homestead applications are submitted through the county property appraiser’s office where the property is located.

Most counties offer:

- Online application portals

- In-person assistance

- Clear documentation checklists

Commonly required documents include:

- Florida driver’s license

- Florida vehicle registration

- Voter registration (if applicable)

- Proof the home is the applicant’s primary residence

Final Thoughts

The phrase “Homestead applications are due by March 1st” may sound simple, but it carries significant financial consequences.

For homeowners, it can mean meaningful tax savings and long-term protection. For Realtors, it is an easy way to demonstrate expertise and care beyond closing.

Deadlines like this should never be missed due to lack of clarity.

Disclaimer: The information and opinions provided are for general educational, informational or entertainment purposes only and should not be construed as legal advice or a substitute for consultation with a qualified attorney. Any information that you read does not create an attorney–client relationship with Barnes Walker, Goethe, Perron, Shea & Johnson, PLLC, or any of its attorneys. Because laws, regulations, and court interpretations may change over time, the definitions and explanations provided here may not reflect the most current legal standards. The application of law varies depending on your particular facts and jurisdiction. For advice regarding your specific situation, please contact one of our Florida attorneys for personalized guidance.

Trust • Experience • Results

Ready to Get Started?

Get started with Barnes Walker today.