Risk and Liability Management for Realtors

With lawsuits against professionals continuing to increase, claims against Realtors have become far more common. Buyers and Sellers often hold unrealistic expectations, believing their Realtor will ensure every aspect of a transaction is favorable, that there will be no surprises, no undisclosed defects, no unexpected costs, and that the outcome will always be optimal. When these expectations are not met, many parties refuse to accept responsibility for their own decisions and instead pursue claims against their Realtor and others involved in the transaction.

The purpose of this article is to help Realtors minimize risk and liability by avoiding common mistakes throughout the transaction process, beginning with contract drafting, continuing through inspections and reports, and ending with closing.

I. Contract Matters

Seller Names

Ensure that all Seller names are correct and that all owners of the property are listed, including spouses if the property is homestead. A copy of the deed should always be obtained to confirm ownership and spelling.

Buyer Names and Ownership

All Buyer names must be accurately listed. If Buyers are unknown, an entity is to be formed, or the contract is assignable, the appropriate assignability language must be included.

When there is more than one Buyer, it is critical to specify the type of ownership and what happens upon death. Joint tenancy with rights of survivorship, tenancy by the entireties, and tenancy in common all have different legal consequences. If ownership is not specified, Florida law presumes tenancy in common.

Legal Description

Always include the correct property address, county, and full legal description. Long legal descriptions should be attached as an exhibit. The legal description must be taken from the recorded deed, not the Property Appraiser, as abbreviated descriptions may be incomplete or inaccurate.

Confirm whether the Seller intends to sell the entire parcel or only a portion. Partial parcel sales and access issues require consultation with an attorney or surveyor.

Personal Property

Clearly identify what personal property is included or excluded from the sale. Attach a detailed list as an exhibit if necessary.

Deposits

Insert an appropriate deposit amount and ensure it is delivered to the correct escrow agent on time. Follow all Florida Real Estate Commission rules regarding receipt, delivery, verification, and disbursement of deposits.

Escrow agents may only disburse collected funds, and checks often require a holding period due to fraud risks.

Financing Provisions

Complete all financing provisions thoroughly and explain deadlines to Buyers. Failure to act within required timeframes can result in default and loss of deposit. Consider adding loan origination fee limits and interest rate terms as additional contract provisions.

Closing Date

Use “on or before” language for the closing date. The closing date controls over all other dates in the contract.

Special Assessments

Ensure the correct Community Development District assessment option is selected. These assessments can involve significant sums, and parties must understand who is responsible for payment.

Inspections and Permits

Recommend all appropriate inspections and allow sufficient time to obtain reports. Document any inspection waivers. Ensure Buyers understand the risks associated with unpermitted or incomplete improvements.

Title Insurance and Surveys

Recommend title insurance and surveys even for cash purchases. Once received, encourage Buyers to review them with legal assistance if needed.

Commissions and Addenda

Include broker names, commission amounts, and administrative fees. Attach all applicable addenda, ensure they are properly completed, and remember that addenda and typed terms control over printed language.

Execution and Delivery

Ensure acceptance deadlines are included, all changes are initialed and dated, and fully executed contracts are delivered on time. The Effective Date occurs upon delivery.

Disclosure Obligations

Under Florida law, Sellers and Realtors must disclose all facts materially affecting property value that are not readily observable. Realtors should insist that Seller Disclosure forms are fully completed and signed by both parties.

II. Post Contract and Pre Closing

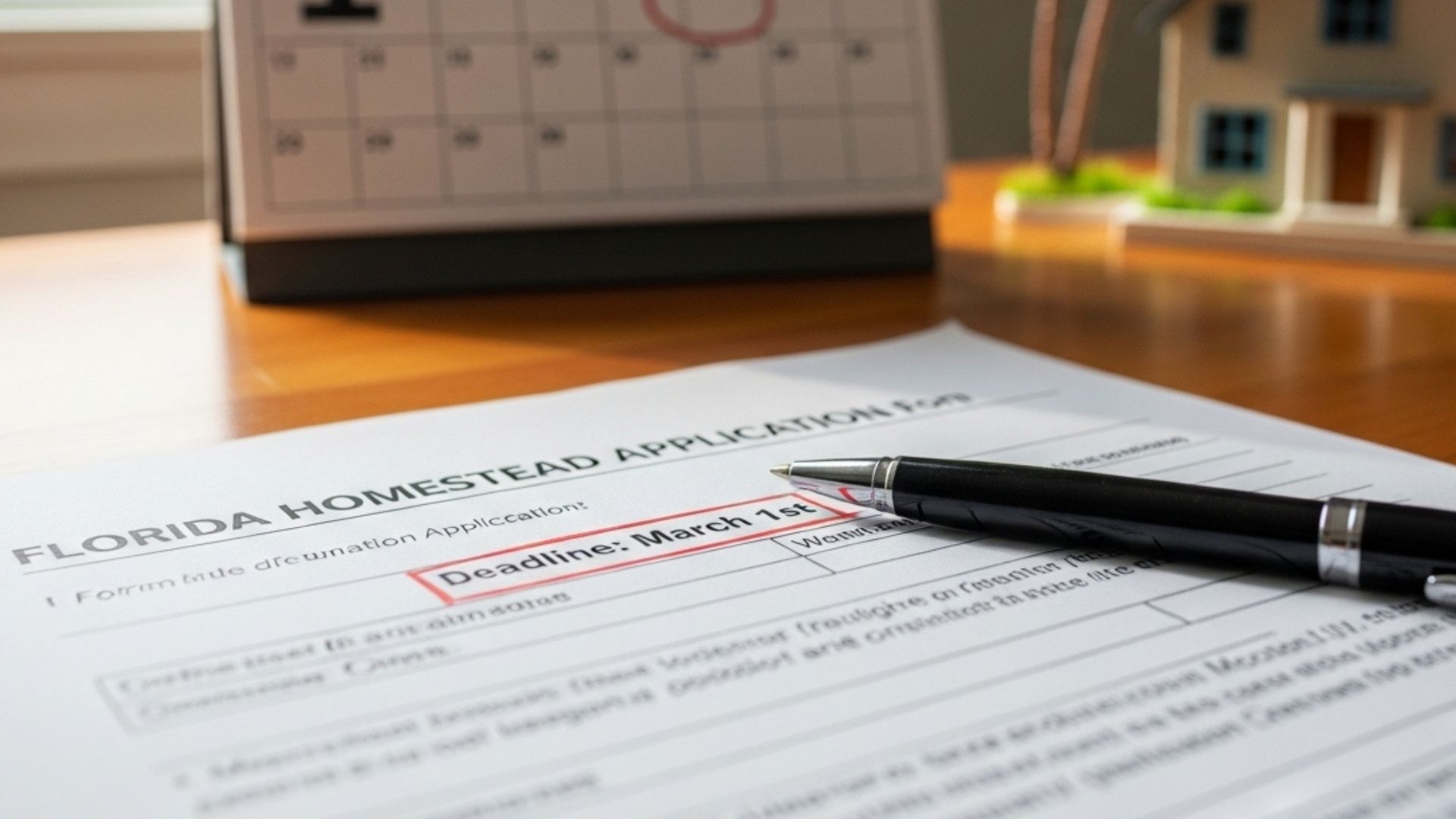

Create checklists outlining duties and deadlines for Buyers and Sellers. Emphasize financing timelines, insurance requirements, utility transfers, and homestead exemption filings.

Coordinate with the closing agent, review settlement statements for accuracy, and ensure compliance with FIRPTA requirements when applicable.

III. Closing

Conduct final walk throughs early, confirm wiring of funds, and ensure that all financial exchanges occur through the closing agent as reflected on the settlement statement. Any off settlement transfers may constitute bank fraud.

IV. Other Considerations

Never facilitate undisclosed payments, pay referral fees to unlicensed individuals, or advertise deceptively. Maintain honesty, diligence, confidentiality, and thorough documentation.

Realtors must deal honestly and fairly, disclose material facts, present offers promptly, and maintain limited confidentiality as required by Florida law.

Recognize professional limits and refer clients to attorneys, CPAs, inspectors, and surveyors when appropriate. Avoid guarantees or predictions and always disclose when in doubt.

Conclusion

Risk and liability management requires attention to detail, clear communication, proper documentation, and adherence to Florida law. Address issues early, remain transparent, and seek professional guidance when uncertainty arises.

Source: Barnes Walker Educational Series

Trust • Experience • Results

Ready to Get Started?

Get started with Barnes Walker today.