Understanding Closing Costs — And Why “Online Calculators” Only Tell Part of the Story

When you’re buying or selling a home, you’ll inevitably hear about closing costs. But what exactly are they? And why do the numbers you see online sometimes change once you dig into the details? This guide will walk you through what closing costs include, what factors make them vary, and what those online “closing cost calculators” can and can’t tell you.

What Are Closing Costs?

In simplest terms: closing costs are the fees and expenses you pay at the final step of a real estate transaction — in addition to your down payment (for buyers) or the sale price (for sellers). They typically include components like:

- Appraisal fees, credit reports, home inspections — Costs tied to evaluating the home’s value and your financing eligibility.

- Title search, title insurance, recording fees, and legal/administrative costs — Ensuring the property has clear ownership and no liens.

- Prepaid items and escrow deposits — Property taxes, homeowner’s insurance, and interest between closing and your first payment.

- Lender fees and loan-origination costs — When financing, lenders charge for underwriting, processing, and optional discount points.

- Taxes, government fees, and location-specific charges — These vary widely by state, county, and municipality.

Most experts estimate that for buyers, closing costs typically range from 2% to 6% of the loan amount or purchase price, depending on region, property type, and loan terms.

Why Closing Costs Vary So Much

Because so many pieces feed into the total, it’s common for two properties in the same neighborhood to have significantly different closing costs. Here are some of the key reasons:

Loan Type and Lender Fees Matter

If you’re taking a mortgage, the loan program affects fees: conventional, FHA, VA, or USDA loans all have different rules and costs. Even within the same loan type, lenders can quote different origination or underwriting fees. Some may offer “no-fee” options that roll costs into the loan — but often with higher interest rates or trade-offs.

Property Type, Location, and Taxes

Local government fees, transfer taxes, title search complexity, and property taxes all depend on the property’s location. A condo, rural home, or multi-unit property may have extra charges compared to a standard single-family residence.

Condition of Property and Due Diligence

If the title search reveals complications — such as multiple owners, liens, or judgments — costs may rise. Likewise, if the appraisal shows issues or the property requires flood certification, expect additional fees.

Timing, Prepaid Items, and Escrow Setup

Closings that occur mid-month often require prepayment of interest and initial deposits into escrow accounts for taxes and insurance. These vary depending on your exact closing date. If the seller prepaid certain costs, prorations may apply.

Negotiation and Who Pays What

Some closing costs can be negotiated — for example, the buyer may ask the seller to pay certain fees or choose a lower-cost title company. Contracts can shift expenses between parties, so there’s no fixed “standard.”

How Online “Closing Cost Calculators” Work — And Their Limitations

Online calculators are useful tools for budgeting, but they rely on averages and assumptions. You typically enter a purchase price, down payment, ZIP code, and loan type to get a ballpark estimate. Many calculators assume a “typical scenario” for your county and loan type.

What They Do Well

- Provide a quick, general estimate so you can plan ahead and avoid surprises.

- Help you compare potential deals and see how purchase price affects closing costs.

- Highlight that closing costs are meaningful — often 2–6% of the loan — reminding buyers to budget accordingly.

What They Can’t Guarantee

- They don’t account for which lender you’ll use, your credit, or loan-specific fees.

- They assume standard local taxes and fees, but some counties have unique costs.

- They can’t predict title search issues, liens, or property-specific problems.

- They may not reflect negotiated items or vendor differences.

- The numbers are not final — your lender’s Loan Estimate and Closing Disclosure will show actual figures before closing.

In short: calculators are a great starting point, but they can’t capture every detail. Real closing costs depend on property condition, location, lender, and timing.

Why These Details Matter for You (as Buyer or Seller)

- Budgeting: Generic calculators may underestimate costs — always leave a buffer.

- Choosing the right lender: Lender fees vary more than most people expect.

- Timing your closing: Adjusting dates can reduce prepaid interest or taxes.

- Selecting the right vendors: Reputable title and escrow companies can prevent last-minute issues.

- Negotiation leverage: Understanding the breakdown helps you request concessions or better terms.

Quick Tips to Make the Most of Closing Cost Estimates

- Ask your lender for a Loan Estimate within three business days of applying — this gives you a detailed preview.

- Review the Closing Disclosure at least three days before closing to confirm final numbers.

- Treat online calculators as rough guides — not guarantees.

- Request a cost breakdown from your lender and title company early in the process.

- Compare lender and vendor quotes to identify which fees are negotiable.

- Plan a small financial cushion in case of higher costs or adjustments.

- Ask your title company for a preliminary estimate based on your purchase price and closing date.

What to Know

Every real estate transaction is unique. Online calculators do a great job helping you prepare, but they can’t replace the precision that comes from working with your lender, title company, and closing attorney. The best approach is to use the calculator as a budget tool, get an official Loan Estimate once you apply, and confirm with your title or escrow team for the most accurate local estimate.

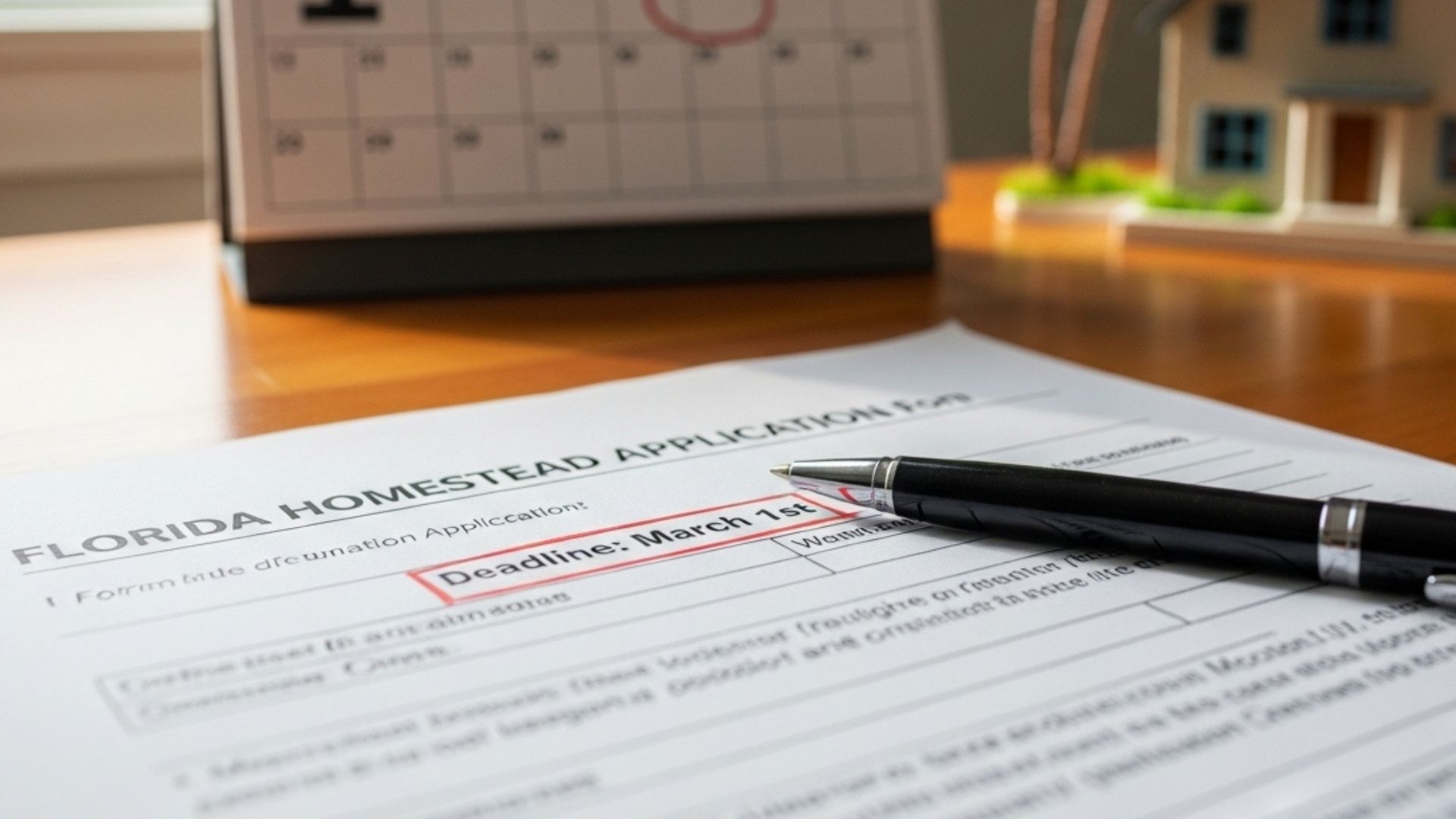

By following this process, you’ll have realistic expectations and fewer surprises when it’s time to close on your Florida home.

Contact Barnes Walker for guidance on understanding your closing costs, reviewing your title documents, or obtaining a detailed estimate tailored to your Florida property. Our firm is backed by professionals who have done this for over 30 years. We’ve seen the good, the bad, and the ugly! Ensuring title transactions go smoothly are a vital process for all parties involved and we aim to deliver the best service.

Trust • Experience • Results

Ready to Get Started?

Get started with Barnes Walker today.